The Colombo Stock Exchange (CSE) renamed its ‘Default Board’ as the ‘Watch List’ with effect from January 2018. This move is said to have been made in a bid to conform to new enforcement procedures of the CSE’s listing rules– primarily in relation to three categories of corporate indiscretions.

These categories encompass the following: violation of corporate governance requirements; late submission or nonsubmission of interim financial statements or annual reports; and incidents of modified audit opinions or an ‘emphasis of matter’ (in the context of going concern) in audited financial statements.

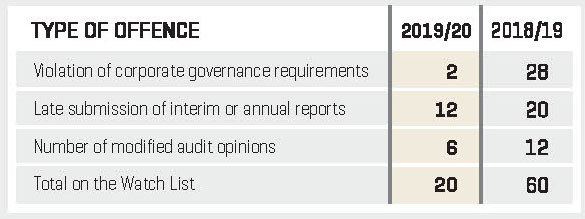

Seven percent of the entities listed on the Colombo bourse – or 20 public companies, to be precise – feature on the list of offenders with respect to the exceptions noted above. In addition, certain quoted companies have been identified as such for multiple violations.

In financial year 2019/20, the number of corporate governance violations increased to two (from 28 in 2018/19). However, the late submission of interim financial statements or annual reports witnessed a decline from 20 in the previous year to 12 in the period under review.

Furthermore, the number of incidents relating to modified audit opinions on listed company financials dropped to nine in 2019/20 compared to 12 in the preceding financial year. Based on the aforementioned information, one may proceed to surmise that the improvement in listed companies conforming to the CSE’s more recent enforcement procedures has been muted… at best.