The Sri Lankan economy grew by 3.7 percent year on year to Rs. 2.3 trillion in the second quarter of 2018, according to the Department of Census and Statistics. As in previous quarters, the highest contribution to GDP came from the services sector (57%), followed by industry (nearly 26%) and agriculture (slightly over 8%).

As for the external economy, the Central Bank of Sri Lanka reports that Sri Lanka’s “external sector performance remained subdued in August,” adding that “the deficit in the trade account narrowed marginally compared to a year earlier as the rise in export income outpaced the growth in import expenditure.”

The Central Bank notes that the financial account of the balance of payments recorded outflows in August due to withdrawals of foreign investments from the government securities market and the Colombo Stock Exchange (CSE) , and continued debt service payments.

It observes: “These developments, alongside the broad based strengthening of the US Dollar, continued to exert pressure on the exchange rate to depreciate.”

During the first eight months of 2018, Sri Lanka’s balance of payments is estimated to have recorded a surplus of US$ 474 million compared to an excess of 2,175 million dollars in the corresponding period of 2017.

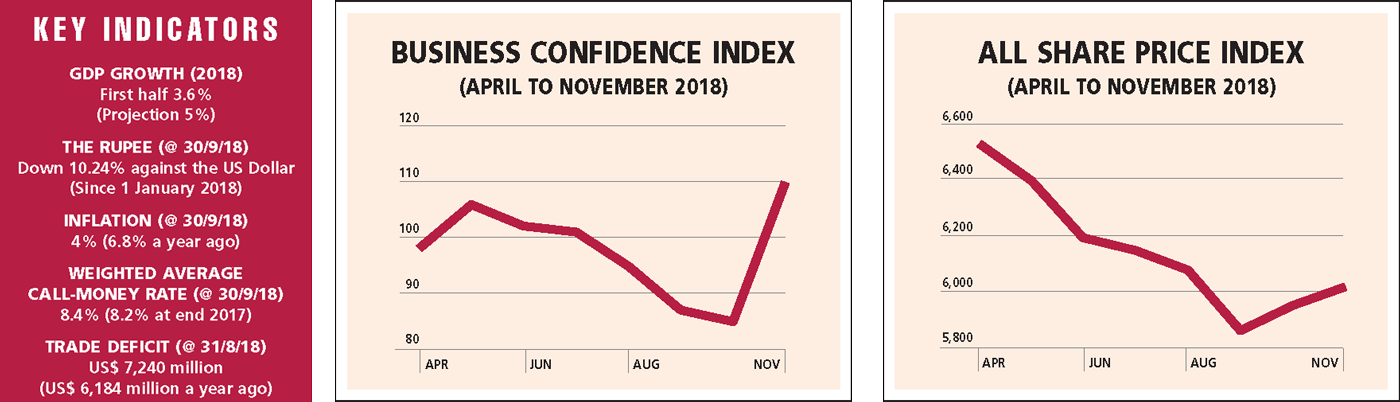

BUSINESS SENTIMENT The LMD-Nielsen Business Confidence Index (BCI) has projected a downward spiral for much of calendar year 2018. After recording marginal gains in the two preceding months, the index shed 11 basis points (to 117) in March, followed by another slump in the next month. Having picked up again in May, the confidence barometer continued to slide in the five months to October when it plummeted to a postwar low of 85.

Despite the onset of the constitutional crisis however, the unique index recorded an increase of 25 points (to 110) in November – although importantly, the latest BCI survey was conducted during the first week of November, which was in the immediate aftermath of the president’s sudden appointment of a new prime minister on 26 October but before the dissolution of parliament on 9 November and what has transpired since then.

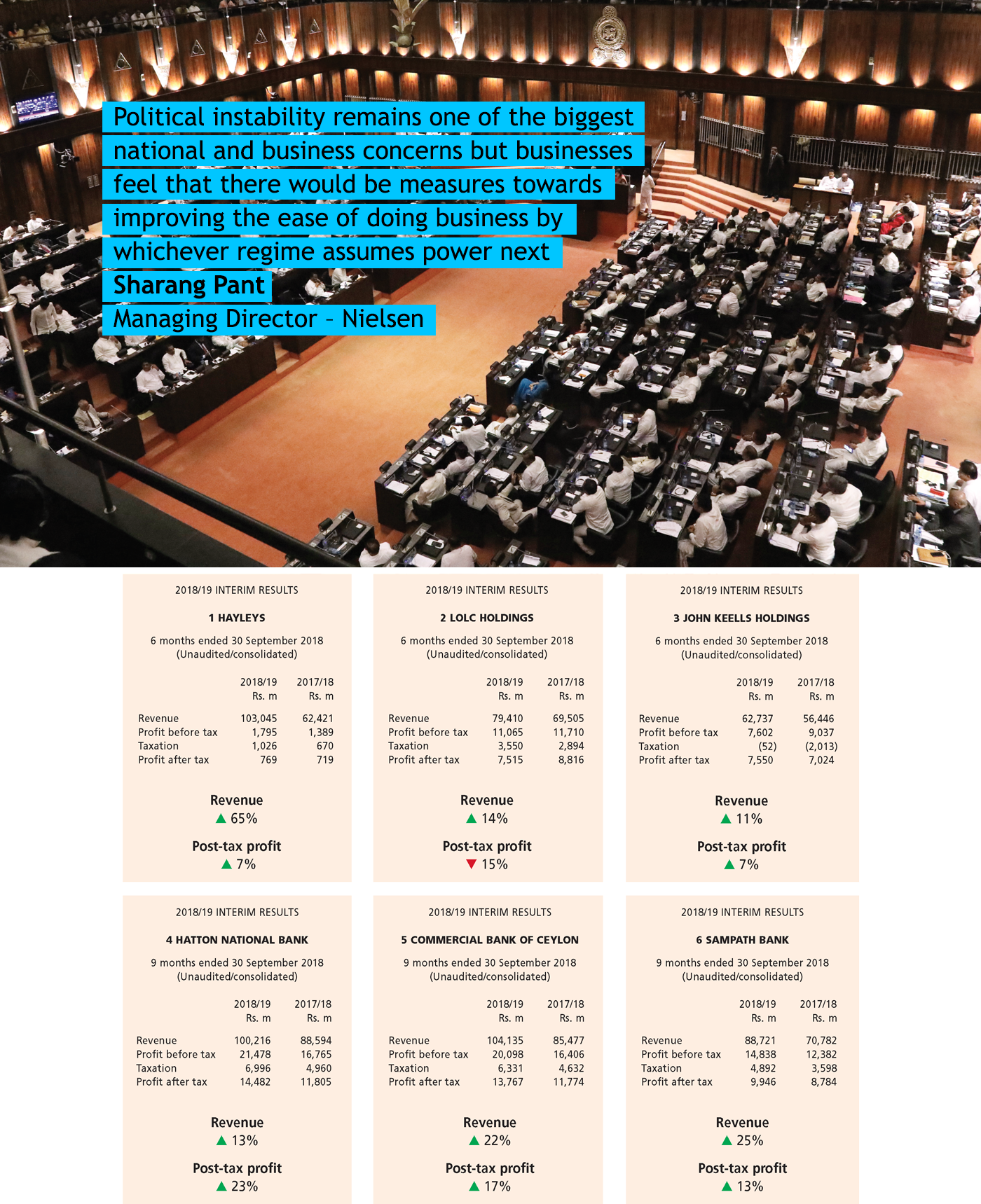

In a recent edition of LMD, Nielsen’s Managing Director Sharang Pant remarked that “political instability remains one of the biggest national and business concerns but businesses feel that there would be measures towards improving the ease of doing business by whichever regime assumes power next.”

CONSUMER CONFIDENCE Meanwhile, the Nielsen’s Consumer Confidence Index (CCI) moved up by eight basis points from the prior month to 54 in November. After a few months of holding back on spending, consumers appear to be more optimistic about job prospects, the state of their personal finances and being able to purchase essential items.

BUDGET DILEMMA Whereas Budget 2019 was expected to be unveiled on 5 November, there’s been no such pronouncement in parliament on account of it being dissolved, which has raised questions about public finances in the forthcoming year.

In the absence of a fully fledged budget therefore, the question on everyone’s mind is whether or not a ‘vote on account’ will take place so that funds can be allocated to state bodies in the New Year.

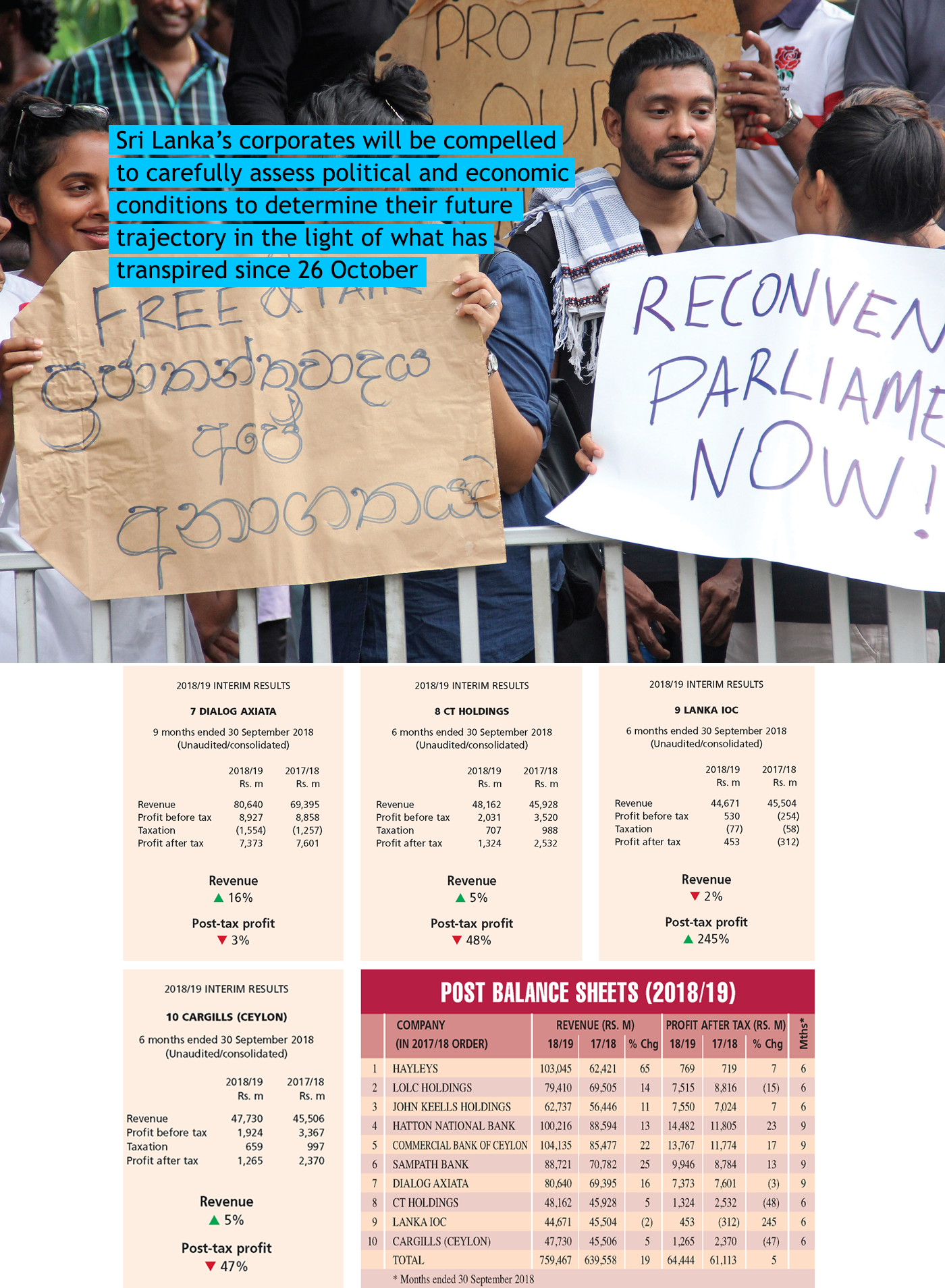

INTERIM RESULTS The latest interim results of the LMD 100 Leaderboard (at 30 September 2018) indicate a healthy uptrend in revenue in financial year 2018/19 with combined turnover of the top 10 listed entities increasing by 19 percent year on year (to almost Rs. 760 billion). This outcome is not dissimilar to that of the LMD 100’s 2017/18 cumulative top line increment (20%).

In contrast however, aggregate profit after tax of the top 10 reflects an increment of only five percent (to slightly over 64 billion rupees) compared to the corresponding period of the previous year.

None of the top 10 companies are so far in the red in financial year 2018/19 (in the prior year, one Leaderboard company reported a post-tax loss on 30 September) but four have had to contend with a profit contraction during this period.

First placed Hayleys reports a 65 percent hike in revenue for the first half of 2018/19 to surpass Rs. 103 billion. However, its bottom line has grown by only seven percent year on year to 769 million rupees in the six months ended 30 September 2018.

A statement issued by Hayleys reveals that “all segments except for plantations have contributed to the healthy expansion in turnover for the group during the period in review.” It adds: “Poor weather conditions and world market prices have hampered the plantations sector.”

Commenting on Hayleys’ performance, Chairman and Chief Executive Mohan Pandithage notes: “The group was able to achieve significant growth driven by the investments we have made towards the acquisition of Singer (Sri Lanka) where the consumer and retail sector has spearheaded the improvement of the top line during the first half of financial year 2018/19.”

LOLC Holdings’ (LOLC) revenue grew by 14 percent from a year back (to nearly 80 billion rupees) in the six months ended 30 September 2018. Its profits however, shrank by as much as 15 percent year on year to register slightly in excess of Rs. 7.5 billion.

In October, the LMD 100’s second ranked entity changed its name from Lanka ORIX Leasing Company to its present form.

Meanwhile, John Keells Holdings (JKH) witnessed an 11 percent expansion in its top line for the six months ended 30 September by surpassing 62 billion rupees. Its bottom line registered a seven percent year on year upside with post-tax profits growing to almost Rs. 7.6 billion.

Chairman Susantha Ratnayake explains in a recent address to shareholders that a decline in the volume of domestic twenty-foot equivalent units (TEUs) impacted profitability in the group’s transportation business during the second quarter of financial year 2018/19.

According to JKH’s Chairman, in the group’s leisure sector the decline in profitability is mainly attributable to its city hotels, partial closure of Ellaidhoo Maldives by Cinnamon for refurbishment and closure of Cinnamon Hakuraa Huraa Maldives for reconstruction work.

The decrease in profitability in its real estate segment “is mainly attributable to Rajawella golf course, which is currently undergoing a relaying of the fairways,” Ratnayake discloses.

As for the group’s consumer foods arm, a drop in volume in the carbonated soft drinks range of the beverages business and costs relating to commissioning a new ice cream factory led to a decline in profitability. Meanwhile, the group’s supermarkets business “continued to record a growth in customer footfall,” according to Ratnayake.

In the nine months ended 30 September 2018, Hatton National Bank’s (HNB) income grew by 13 percent year on year to surpass Rs. 100 billion. Meanwhile, its tax-paid profit increased by a more impressive 23 percent from the prior year (to 14.5 billion rupees). The bank notes that “all group companies were profitable during the period and contributed to HNB group profitability.”

“Prudent asset and liability management facilitated a 15.5 percent year on year growth to Rs. 34.2 billion in net interest income for the period despite challenging market conditions,” HNB adds.

Commercial Bank (ComBank) reported a consolidated income of Rs. 104 billion (up 22% year on year) for the first nine months of calendar year 2018 while its bottom line appreciated by 17 percent year on year (to reach 13.8 billion rupees).

Commenting on the bank’s performance at the end of the third quarter of 2018, Chairman Dharma Dheerasinghe states: “Our nine month performance reflects the vagaries of the period with the bank overcoming the challenges of slower business growth through a combination of prudent banking practices and agile responses to changing conditions. We expect conditions to be even more challenging in the fourth quarter but are confident of weathering them in our own way.”

ComBank’s Managing Director (at the time) Jegan Durairatnam notes that rising non-performing loan (NPL) ratios are a concern for the entire sector and are compelling banks to increase provisioning for bad debts.

He discloses that ComBank’s NPL ratios remain lower than sector averages while “timely repricing of liabilities and strong deposit growth have enabled the bank to keep interest expenditure growth to a significantly lower rate than interest income growth. Nevertheless, the contribution of net interest income to operating income has declined, indicating that fund based operations of the bank are now contributing substantially to income.”

Sampath Bank reported a top line of Rs. 88.7 billion (up 25% year on year) for the first nine months in 2018 while its after-tax profit climbed by 13 percent year on year (to nearly 10 billion rupees).

Telecom giant Dialog Axiata saw its consolidated revenue expand by 16 percent for the period under review to more than Rs. 80 billion for the nine months ended 30 September. Its after-tax profit however, contracted by three percent year on year (to Rs. 7.4 billion).

While the group continued its growth momentum across the mobile, fixed line, digital pay television and tele-infrastructure businesses, Dialog says the erosion of profit after tax was impacted by “non-cash translational foreign exchange losses to the value of Rs. 1.8 billion during the quarter, accruing from the depreciation of the Sri Lankan Rupee relative to the US Dollar by 6.8 percent quarter on quarter.”

CT Holdings generated a consolidated revenue of over Rs. 48 billion (up 5% year on year) in the first half of financial year 2018/19 while its half-yearly post-tax profit almost halved to 1.3 billion rupees (from Rs. 2.5 billion rupees a year ago).

Its operational review notes: “Despite transient challenges faced by certain sectors, the group remains excited about the promise and potential of its business units. Recognising the importance of refining focus in order to narrow gaps in performance, the group commits to maintaining its thrust towards investing in growing the businesses.”

Energy behemoth Lanka IOC returned to the black in the first half of financial year 2018/19 with an after-tax profit of Rs. 453 million (against a loss of 312 million rupees in the corresponding period of the prior year). However, its turnover declined (by 2% year on year) to 44.7 billion rupees.

And lastly on the 2018/19 LMD 100 Leaderboard, Cargills (Ceylon) enjoyed an increase in revenue of five percent year on year (to almost Rs. 48 billion) although profit after tax fell to 1.3 billion rupees – versus a profit of 2.4 billion rupees in the corresponding period of 2017/18.

Cargills asserts that “macroeconomic challenges and exigencies both domestically and internationally continued to place pressure on the domestic consumption environment. This in turn impacted performance vis-à-vis the previous year.”

FUTURE OUTLOOK Sri Lanka’s corporates will be compelled to carefully assess political and economic conditions to determine their future trajectory in the light of what has transpired since 26 October.

As for the nation’s premier listed company rankings in 2018/19, based on the interim financial statement disclosures at 30 September it would seem that the status quo could remain although JKH and the two leading private sector banks (HNB and ComBank) may well be in contention for the No. 3 spot on the podium.