YEAR IN REVIEW In 2017, the stock market enjoyed a growth trajectory with a turnaround in indices and record-breaking foreign inflows supported by higher volumes. In addition, renewed optimism created a platform for investors and companies to invest through the capital market, according to the 2017 Annual Report of the Colombo Stock Exchange (CSE) .

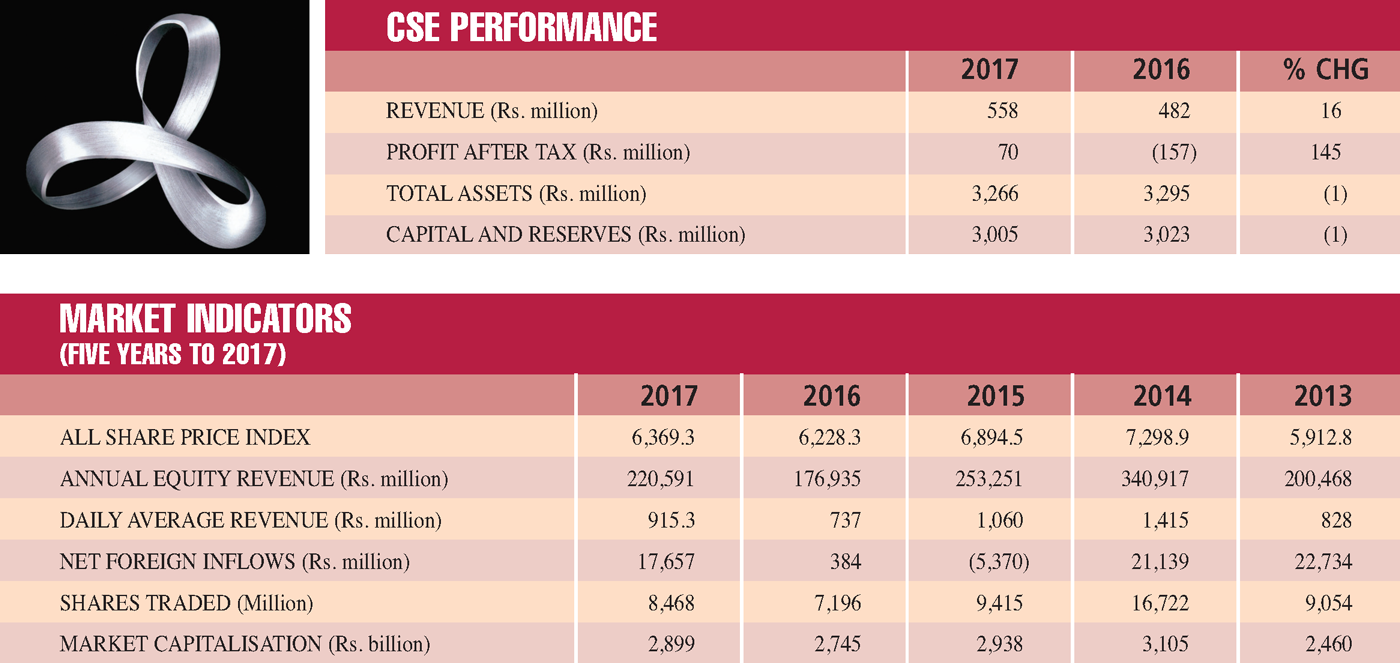

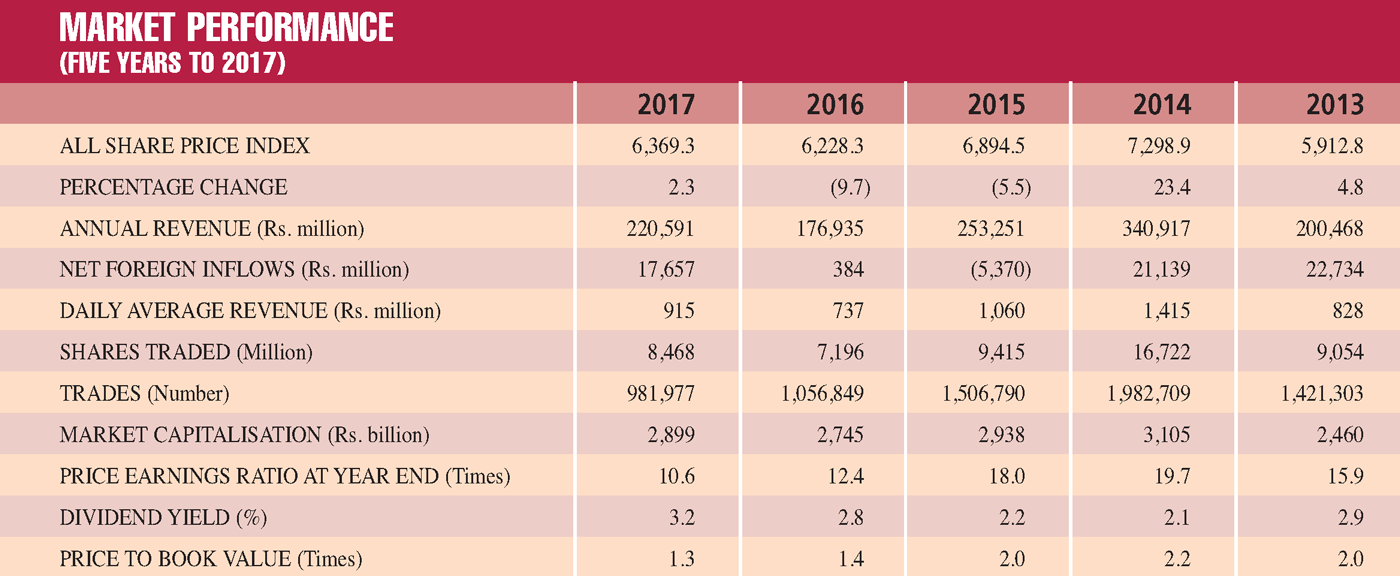

The report reveals that market turnover increased by 25 percent in 2017 to Rs. 220 billion – this result was propped up by foreign purchases, which reached a record high for a calendar year of 112 billion rupees (up 51% year on year).

CSE Chairman Ray Abeywardena remarks: “This is particularly encouraging as the value of share trading globally decreased by 2.6 percent in 2017 largely due to the decline observed in the Americas and the Asia-Pacific regions.”

He also notes that during calendar year 2017, “domestic turnover increased by 14 percent to Rs. 117 billion despite the prevailing high interest rates, which dampened interest in equity markets. The daily turnover average of 915 million rupees was an improvement over the previous year’s average of Rs. 737 million.”

Meanwhile, market capitalisation appreciated to Rs. 2,899 billion as issuers raised 74 billion rupees through the CSE using both equity and debt IPOs.

“While acknowledging that we need even higher levels of performance to meet the country’s aspirations, I believe that the performance in 2017 has laid a strong foundation for growth, and plans are being implemented to build on [the] same for long-term wealth and value creation for market participants,” Abeywardena maintains.

The Chairman of the stock exchange also outlines the level of foreign investor interest in 2017: “The road shows in Melbourne and Sydney attracted a fair amount of interest, and had immediate results as the Sri Lankan diaspora showed a keen interest in opportunities for growth in the Colombo bourse. The road show in New York attracted over 100 fund managers, and this also supported foreign inflows and increased confidence in the market.”

Furthermore, as Sri Lanka was classified as a frontier market by Morgan Stanley Capital International (MSCI), the CSE collaborated with the Securities and Exchange Commission (SEC) and the stockbroking community to work towards Sri Lanka’s reclassification to emerging market status, which would offer broader visibility as a portfolio investment destination.

Abeywardena cautions that “policy instability remains a key concern for market participants, dampening the growth potential of the market given its strategic location, and diplomatic ties with South Asian and other Asian countries.”

He also reveals that proposals to launch a Multi Currency Board were at an advanced stage, pending final regulatory approvals, with its launch set for 2018.

“Initially, only foreigners will be allowed to buy and sell shares in the Multi Currency Board, and there is [an] opportunity for local unlisted and listed companies to also list on the new board,” Abeywardena reveals.

Proposals for the launch of an SME Board in 2018 were expected to enable SME companies to list, and provide an exit mechanism for private equity investors in those companies as well as in startups.

As Abeywardena explains, “this will complete the value chain from a startup through a PE firm to migrate to the SME Board, to the Diri Savi Board and finally to the Main Board or Multi Currency Board listing.”

He underscores the fact that “political stability and a clear direction in policy” are necessary to enhance investor confidence necessary for the functioning of efficient capital markets. “Additionally, the prevailing high interest rates deter issuers and investors from accessing equity markets, and a rationalisation would enhance the prospects for efficient functioning of capital markets.”

Abeywardena continues: “Local captive funds must also be encouraged to enhance asset allocations to strengthen equity portfolios. Their participation must at least be equal to foreign inflows as they are a key stakeholder in nurturing vibrant equity markets. Additionally, companies also need to unlock and increase the float to create more trading opportunities for investors as liquidity remains a concern.”

The CSE’s Chief Executive Officer Rajeeva Bandaranaike observes: “Debt market turnover increased by 23 percent to Rs. 3.5 billion as the number of trades more than doubled, reflecting growing interest in debt. Capital raised through rights issues increased from Rs. 2.5 billion in 2016 to Rs. 50.6 billion in 2017, making it the highest capital raised through rights issues in the market in a given year.”

However, total capital raised in the primary market through the bourse declined by 13.9 percent “due to a sharp decline in debt IPOs and to a lesser extent, equity IPOs,” according to its CEO.

He believes that the CSE needs to be transformed into a “vibrant liquid market that offers value to investors and issuers” to which end it will be necessary to improve the depth and breadth of the market in terms of more larger listed companies, a larger free float of shares, a wider spread of investors and a more diversified product range.

The future strategy would also entail the development of innovative technology that has the agility to respond to market needs, improvement of risk management capabilities, establishment of an effective market regulatory framework to build investor confidence, improvement of industry governance practices, and engaging in institutional and capacity building.

Bandaranaike emphasises: “Our vision of creating wealth through securities can be achieved if we are able to spur market activity through more transactions, achieve higher levels of investor participation and add more new listings.”

MARKET UPDATE Offering insights on recent developments in the November edition of LMD, analyst and columnist Hasitha Premaratne says he expects “the market to remain volatile and the downward trend to adjust somewhat with a turnaround expected. Corporate earnings are also expected to be somewhat stable in the second half of the year. Overall, growth is expected.”

He notes that “given the higher corporate earnings and the market’s downward trend, investors should witness share valuations becoming more attractive. This will provide opportunities for bargain hunters to enter the market and gradually accumulate fundamentally sound counters.”

And as the global market implications of China-US tensions and interest rates in the United States also come into play, Premaratne remarks that “these factors could compel foreign investors to sell, which in turn would lead to a further deterioration of the market.”

“The panic in the global market is likely to continue amid uncertainty on multiple fronts,” he adds.

Meanwhile, the President of the Colombo Stockbrokers Association Prashan Fernando, who voiced his views on the twice monthly TV programme Benchmark in May, pointed out that liquidity was one of the major concerns for listed companies due to a lack of attractive stocks for foreign investors, adding that there are “a handful of companies to which foreign funds are attracted.”

Fernando revealed that the lack of investment by the government in the stock market was another concern because of the negative impression this conveys to retail investors. Moreover, he singled out the ability of companies to deleverage and reduce the size of their balance sheets as one of the opportunities there are in the capital market.

Among the promising sectors Fernando identified were banking, insurance and possibly utilities – if they could be convinced to pursue listing. He remarked: “In other countries, being listed enables utility companies to escape debt traps.”

He also pointed to the lack of market knowledge as one of the reasons for Sri Lanka not jumping on the internet trading bandwagon and suggested that the curriculum for younger students be revised to enable them to understand the benefits of online trading.

“A lot more people in other emerging markets are online. In countries such as Thailand and Malaysia, housewives are able to trade; but we have yet to reach that stage,” he lamented.

FUTURE STANCE Whereas the bourse may have entered a period of relative stability in 2017, the latter half of this year has been anything but certain. Both on the local front as well as internationally, shocks to the system have become seemingly commonplace – and it goes without saying that this has affected the stock market.

Looking ahead, given the grave uncertainty that the nation faces at this time, the call is for a herculean effort on the part of the powers that be to restore confidence in the economy and indeed, the bourse.