The latest edition of the LMD 100 presents a detailed analysis of how Sri Lanka’s leading listed entities performed in financial year 2017/18 – and this could best be described as a broadly healthy performance in the fading light of a seemingly never-ending state of chaos and confusion.

What is even more heartening perhaps is the fact that Sri Lanka Inc. has stayed afloat despite the predominantly underwhelming trend of the biz sentiment graph – the

LMD-Nielsen Business Confidence Index (BCI) – for the most part of calendar year 2018.

LEADERBOARD The LMD 100 is spearheaded by the export oriented conglomerate Hayleys, which has strengthened its presence among Sri Lanka’s listed corporates. Meanwhile, banking entities, together with representatives from the diversified, telecommunications and retail domains, are staking their claim to fame as dominant forces in the LMD 100 Leaderboard for financial year 2017/18.

John Keells Holdings(JKH) was ranked No. 1 in as many as eight of the first 10 years of The LMD 50 (the pioneering precursor to the LMD 100), only to be surpassed by Sri Lanka Telecom (SLT) – a partnership between the Government of Sri Lanka and Malaysian telecom giant Maxis, which went public in 2003.

SLT in turn helmed the rankings for four consecutive years before surrendering its rung at the top of the ladder to the petro giant from neighbouring India – Lanka IOC (LIOC) was The LMD 50’s numero uno until 2009/10 with its reign lasting three financial years.

And Hayleys, which was runner-up to JKH in many of the early years – and pipped the latter to the winning post in 1995/96 and 1996/97 – raced ahead of SLT and LIOC in 2010/11 to occupy the podium’s second place.

Turning to the latest LMD 100 pecking order, Hayleys retains the No. 1 spot while

Lanka ORIX Leasing Company (LOLC) moves up the ladder to sit in second place. JKH falls to third place and is followed by

Hatton National Bank (HNB).

Commercial Bank of Ceylon (ComBank) rounds off the top five in the latest edition of Sri Lanka’s premier listed company rankings.

Sampath Bank (No. 6),

Dialog Axiata (in seventh place) and

CT Holdings (No. 8) make up the remainder of the Leaderboard, alongside Lanka IOC and

Cargills (Ceylon) who are ranked ninth and 10th respectively.

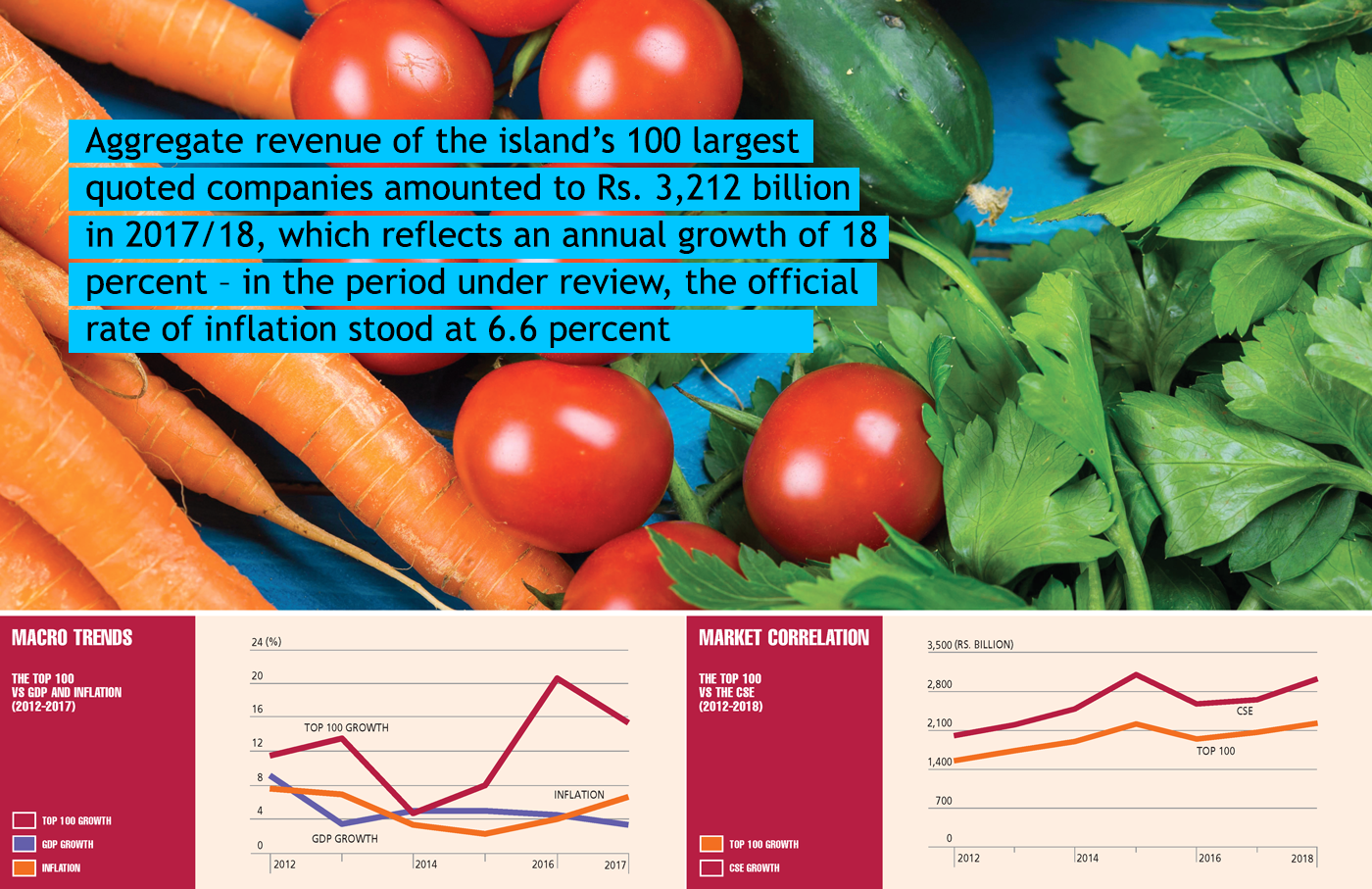

REVENUE STREAMS Aggregate revenue of the island’s 100 largest quoted companies amounted to Rs. 3,212 billion in 2017/18, which reflects an annual growth of 18 percent – in the period under review, the official rate of inflation stood at 6.6 percent so the LMD 100’s combined top line is in substantially positive territory.

In the previous financial year, the aggregate turnover of LMD 100 companies improved by 13 percent while inflation stood at four percent.

As many as 46 (versus 44 in the preceding year) LMD 100 entities registered an annual turnover of more than 20 billion rupees in financial year 2017/18 – and furthermore, the five highest ranked corporates (Hayleys, LOLC, JKH, HNB and ComBank) surpassed the Rs. 100 billion mark.

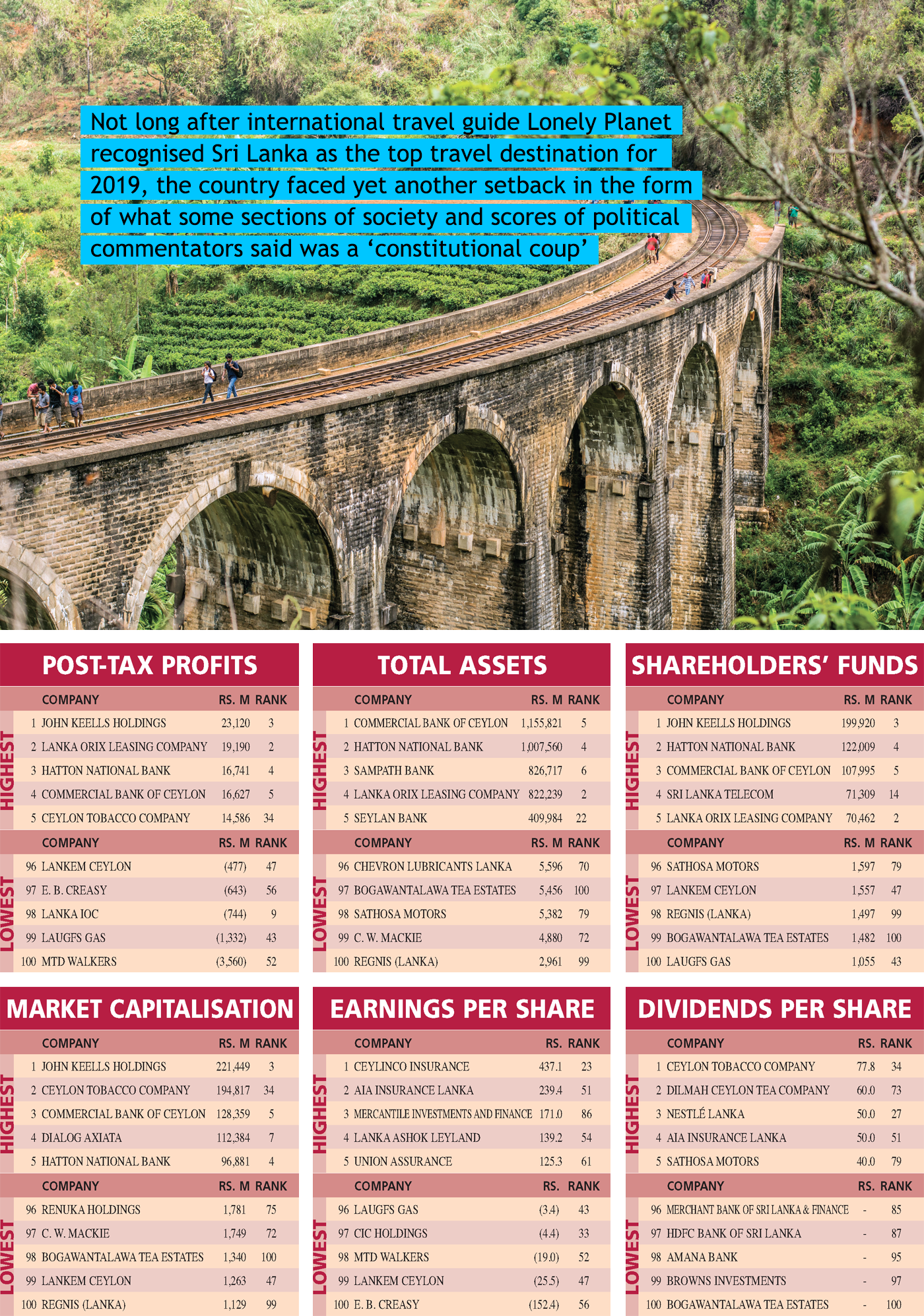

In the context of revenue growth, LOLC comes out on top with a 63 percent year on year uptick (to Rs. 150 billion), making it the only entity to report a top line improvement in excess of 50 percent among the top 50 in the financial year under review. BOTTOM LINES At Rs. 281 billion, the 2017/18 cumulative post-tax profit of the LMD 100 improved by 14 percent compared to the previous year.

As for other notable landmarks, the profit after tax of JKH, LOLC, HNB, ComBank,

Ceylon Tobacco Company (CTC), Sampath Bank,

Ceylinco Insurance and Dialog crossed the Rs. 10 billion in financial year 2017/18.

However, nine (versus 10 in the prior year) of Sri Lanka’s LMD 100 companies ended financial year 2017/18 in the red – viz.

Renuka Foods, Hayleys Fabric, Colombo Fort Land, CIC Holdings, Lankem Ceylon, E. B. Creasy, LIOC, LAUGFS Gas and MTD Walkers.

Among this year’s movers and shakers are

Lion Brewery Ceylon (tax-paid profit up by 227%), Ceylon Beverage Holdings (205%), Ceylinco Insurance (143%) and

Softlogic Holdings (136%).

TAXATION On average, an LMD 100 entity forked out one billion rupees in taxation for 2017/18, which represents an annual hike of 20 percent from the previous year’s tax bill of Rs. 866 million.

The Leaderboard accounts for more than a third of the combined taxes of the LMD 100 in 2017/18 as the top 10’s payout increased by 14 percent (versus 25% in 2016/17) to over 35 billion rupees.

As in the past, CTC’s contribution to state coffers during the period was the highest among the nation’s listed companies on account of a tax charge of nearly Rs. 10 billion.

ASSET VALUES The largest listed entities in Sri Lanka enjoyed a 16 percent appreciation in total assets from the previous year, which is in line with the uplift in asset values recorded in both 2016/17 and 2015/16 as well.

The banking sector holds sway in the LMD 100’s asset related rankings as it represents almost half of the combined portfolio of assets of the premier listed entities in Sri Lanka.

ComBank continues to be at the forefront of balance sheet strength with Rs. 1,156 billion in assets at 31 December 2017, followed by fellow private sector banking giants HNB (Rs. 1,008 billion) and Sampath Bank (Rs. 827 billion).

Meanwhile,

LOLC Finance is ahead of the pack for highest percentage gain in asset values among the top 100 – its total assets of 211 billion rupees reflect a 72 percent appreciation from the end of the preceding year. Hayleys is next in line on the back of a 60 plus percent uplift in asset values in 2017/18.

MOVERS AND SHAKERS

Dilmah Ceylon Tea Company made the most notable progress in the climb up the listed company rankings by entering the top 100 list at No. 73.

AIA Insurance Lanka also achieved a similar distinction by jumping 20 places up the LMD 100 scale to 51st place.

In sum, as many as 60 of the island’s largest corporate entities climbed up the LMD 100.

SECTOR RANKINGS The diversified holdings lead the way amongst the leading listed companies in Sri Lanka with their cumulative income representing 28 percent of the LMD 100’s combined revenue during the period under review.

The banks follow as the second largest player in the LMD 100 with an aggregate income in excess of Rs. 553 billion and a share of 17 percent of cumulative revenue in the 12 month period. The sector also accounts for 23 percent of LMD 100 profits and 26 percent of shareholders’ funds in 2017/18.

INVESTOR YARDSTICKS JKH leads the way with a market capitalisation of Rs. 221 billion at 31 March 2018 and is followed by CTC, which registered a market cap of 195 billion rupees at the end of financial year 2017/18. ComBank and Dialog were the only other entities to record a market capitalisation in excess of Rs. 100 billion on this day.

As for aggregates, the LMD 100’s combined market capitalisation increased by 11 percent (to Rs. 2,242 billion) between 1 April 2017 and 31 March 2018.

Similar to its tally in the preceding financial year, 10 of the island’s 100 leading listed corporates maintained an equity value in excess of 50 billion rupees at the end of 2017/18. The top five (JKH, CTC, ComBank, Dialog and

Nestlé Lanka) accounted for a little over a third of the LMD 100’s combined market cap.

THE FUTURE Not long after international travel guide

Lonely Planet recognised Sri Lanka as the top travel destination for 2019, the country faced yet another setback in the form of what some sections of society and scores of political commentators said was a ‘constitutional coup.’

And it goes without saying that the repercussions of recent events in parliament following its prorogation, mass protests on the streets, and wheeling and dealing behind closed doors are likely to be felt across the nation’s corporate landscape in 2019.

Responding to this inexplicable turn of events, the joint chambers of commerce – the Ceylon Chamber of Commerce, Federation of Chambers of Commerce and Industry, Ceylon National Chamber of Industries, National Chamber of Commerce, Chamber of Young Lankan Entrepreneurs, National Chamber of Exporters, Sri Lanka Apparel (JAAF)and

Chamber of Construction Industry of Sri Lanka – issued a statement expressing concern that any unresolved political uncertainty may result in adverse consequences for the country.

The joint communiqué notes: “We request the political authorities to resolve issues through the democratically established institutions as early as possible. We appeal to the political parties to ensure that law and order prevails, and that danger to the life and property of citizens is prevented. All parties should act in the best interests of our country, our people and the national economy.”

Amidst the political deadlock and in the absence of an official budget presentation in parliament on 5 November, a newly overhauled finance ministry announced budget-like amendments to key economic policies and taxes. These included reductions to commodity levies, lower fuel prices, subsidised prices and other concessions targeting the agriculture sector, and a reduced telecommunications levy among others.

Fitch Ratings’ assessment of recent events concludes that Sri Lanka’s political standoff could lift its refinancing risk as it creates uncertainty over further progress on reform and fiscal consolidation: “Prolonged political upheaval accompanied by deterioration of policy continuity could undermine investor confidence and make it more challenging for the government to meet its large external financing needs in 2019-2022.”

“The outcome of the power struggle and possible implications for the sovereign rating (B+/Stable) remain uncertain… We last affirmed Sri Lanka’s sovereign rating in February 2018. At the time, we noted that potential negative rating sensitivities included deterioration of policy coherence and credibility, a derailment of the IMF support programme or a reversal of fiscal improvements leading to a failure to stabilise government debt ratios,” it cautions.

Moreover, the rating agency states that “a delay to the budget [which was due to be presented on 5 November] or slippage on targets could further undermine near term investor sentiment, and might also jeopardise compliance with IMF targets under the IMF supported programme, which is in any case due to expire in mid-2019. The government is also behind schedule on introducing automatic electricity pricing – a structural benchmark under the IMF programme – which could see continued delays under the political upheaval.”

As for international affairs, the

IMF’s World Economic Outlook (WEO) published in October points to global growth of 3.7 percent in 2018 and 2019 – that’s 0.2 percentage points below the April 2018 WEO even though it is well above its level in the four years to 2016. It asserts that “differences in the outlook across countries and regions are notable.”

“Global growth is expected to remain steady at 3.7 percent in 2020 as the decline in advanced economy growth with the unwinding of the US fiscal stimulus, and the fading of the favourable spillovers from US demand to trading partners is offset by a pickup in emerging market and developing economy growth. Thereafter, global growth is projected to slow to 3.6 percent by 2022/23, largely reflecting a moderation in advanced economy growth toward the potential of that group,” the IMF reports.

Furthermore, major world events such as trade wars and geopolitical conflicts are likely to have a bearing on Sri Lanka’s external sector prospects, which would in turn impact the fortunes of listed corporates in the current financial year and beyond.

Therefore, corporate resilience will be the name of the game because fortune favours the brave.