Sri Lanka’s economy recorded subdued growth of 2.3 percent year on year in 2019 compared to 3.3 percent in 2018. This was driven by higher consumption, and an improvement in

the external balance of goods and services, according to the Central Bank of Sri Lanka (CBSL).

CBSL notes that the agriculture sector recorded modest growth in 2019, “reflecting the impact of the extreme weather conditions observed during most months of the year.”

The monetary authority also states that growth in the services sector was halved “as the impact of the Easter Sunday attacks slowed activities in most of the subsectors” whereas the industry sector performance improved somewhat in 2019.

SERVICES In calendar year 2019, services related economic activities (nearly 57% of GDP) expanded by 2.3 percent year on year in value added terms compared to the 4.6 percent increase in 2018 and recording its lowest growth in nearly five years.

According to the Central Bank, the impact of the Easter Sunday attacks mainly extended to tourism related ser- vices including accommodation, trans- portation, wholesale and retail trade activities, and other personal services.

CBSL adds: “Accommodation, food and beverage service activities contract- ed during the year, dampening the over- all growth of services, while wholesale and retail trade activities, other personal services and transportation activities – which were the major contributors to the overall growth of services – grew at a slower pace compared to the previous year.”

The Central Bank also cites increases in other segments including financial services, real estate, public administration, telecommunication, insurance, education, professional services, human health, and IT programming consultancy and related services during the year.

INDUSTRY The value added of the industry sector grew by 2.7 percent in 2019 versus a mere 1.2 percent increase in the preceding year, mainly benefitting from a recovery in construction, and mining and quarrying activities, which jointly account for a major share of industrial activities.

Manufacturing activities recorded slower growth in 2019. Meanwhile, other industry activities – viz. electricity and gas related activities, sewerage, waste treatment and disposal activities, and water collection, treatment and supply activities continued their positive developments during the year.

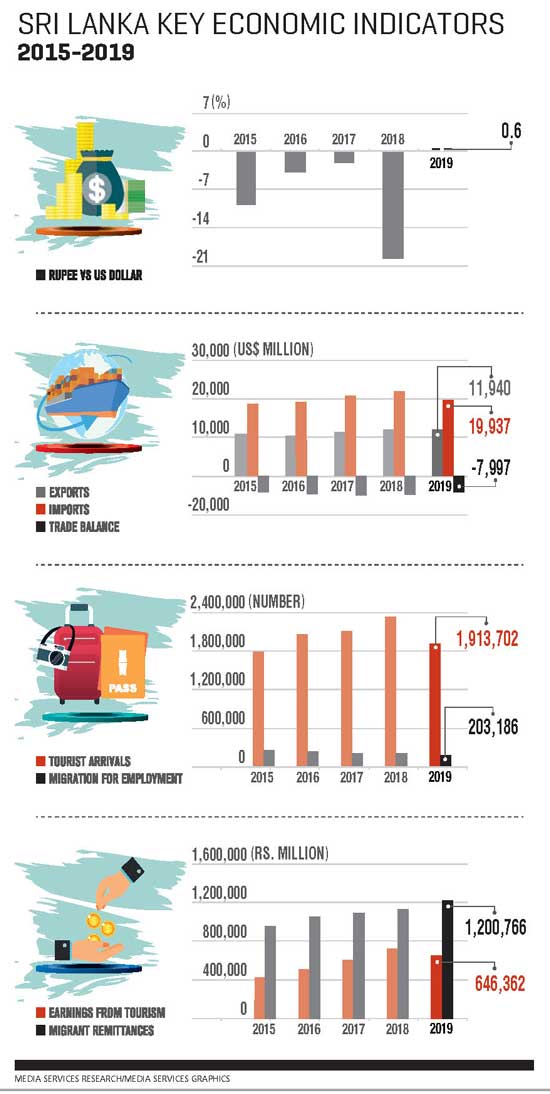

AGRICULTURE Against a backdrop of a considerable decline in key activities including fishing, forestry, and grow- ing of major crops such as rubber and tea, agriculture activities accelerated by a marginal 0.6 percent in value added terms in 2019 compared to the 6.5 percent growth of the year prior.

AGRICULTURE Against a backdrop of a considerable decline in key activities including fishing, forestry, and grow- ing of major crops such as rubber and tea, agriculture activities accelerated by a marginal 0.6 percent in value added terms in 2019 compared to the 6.5 percent growth of the year prior.

Furthermore, CBSL notes that “growing of cereals, spices, plant propagation and support activities to agriculture, and growing of other bev- erage crops such as coffee, cocoa, rice and other perennial crops also con- tracted, deterring expansion in overall agriculture activities, mainly on account of the unexpected weather related disturbances that occurred dur- ing the year.”

VIEWPOINTS In its latest update to the Asian Development Outlook (ADO) report in September 2020, the Asian Development Bank (ADB) in its commentary on Sri Lanka states that “the forecast for GDP growth in 2021 is maintained to accommodate a low base this year and with the expectation of higher growth in the major advanced economies as they return to normal. GDP will nevertheless remain below its pre-COVID level.”

In the first quarter of 2020, GDP contracted by 1.6 percent year on year as agriculture fell by 5.6 percent, manufacturing by 4.1 percent in line with a decline in garment exports and construction by 16 percent as investment expenditure plunged. Expansion in services was supportive but eased to 3.1 percent on lower household consumption expendi- ture.

While expanded government consumption by 28.8 percent helped stabilise the economy, unemployment reached a 10 year high of 5.7 percent in the first quar- ter – a rate last witnessed at the end of the civil conflict in 2009.

On the monetary policy front, the Central Bank reduced policy rates by 200 basis points and boosted bank liquidity through open market operations. Domestic credit grew by 12.4 percent up until July 2020, driven by credit to the government and state owned enterprises while private sector credit expand- ed by a marginal 0.6 percent.

The ADB remarks that “cash transfers and the expan- sion of existing social protection schemes provided some relief, but their scale, scope and duration provid- ed only a limited stimulus to the economy.”

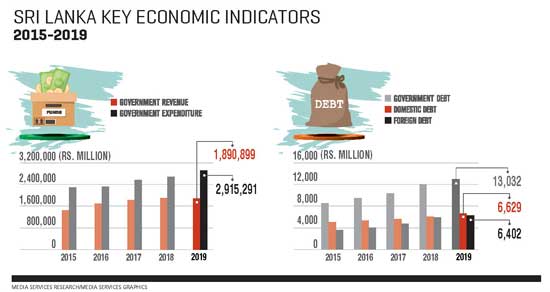

In the first half of the year, revenue from taxation fell by 28.4 percent year on year following tax cuts imple- mented in late 2019 and a fall in economic activity under COVID-19. Recurrent expenditure increased by 10.5 percent while capital spending fell by 43.5 per- cent. Nevertheless, the deficit ballooned by 41 percent year on year.

Sri Lanka also faced a sovereign downgrade for its elevated deficits and large debt refinancing needs.

The regional development bank revised its inflation forecast up for 2020 “after tight food supply and high- er import tariffs pushed food inflation to an average of 11.9 percent in the first eight months of 2020, more than double the Colombo consumer price average of 4.8 percent..”

Import and capital export controls were introduced to counter pressure on reserves and the exchange rate in the wake of currency volatility in March and April, sta- bilising the Sri Lankan Rupee’s depreciation at around 2.5 percent in the year to August.

The trade deficit shrank by 8.9 percent in the first half of 2020 as imports contracted by 20 percent – with sharp declines in fuel, textile intermediates and invest- ment goods – and exports by 26.7 percent.

Meanwhile, the ADB notes that “remittance inflows that provide much needed financing for the trade deficit fell by 5.5 percent till end July but… picked up since May, likely due to returning migrants transfer- ring their savings and an election related bump as seen historically.”

Tourist earnings also declined by 54.9 percent during the same period.

“Yet, current account deficit forecasts are trimmed for 2020 and 2021, reflecting a larger than expected contraction in imports and a better recovery in exports,” the ADB adds, while pointing to a moderate decline in foreign exchange reserves from US$ 7.6 bil- lion at the beginning of the year to 7.1 billion dollars in July.

Meanwhile, the IMF forecasts that the Sri Lankan economy will contract by 4.6 percent in 2020, and reg- ister growth of 5.3 percent and 4.8 percent in 2021 and 2025 respectively, according to the October 2020 edi- tion of its World Economic Outlook (WEO) report.

At the conclusion of an IMF staff visit in February 2020, mission chief Manuela Goretti noted: “The pri- mary surplus target under the programme supported by the Extended Fund Facility (EFF) was missed by a siz- able margin in 2019 with a recorded deficit of 0.3 per- cent of GDP due to weak revenue performance and expenditure overruns.”

She also stated that “under current policies as dis- cussed with the authorities during the visit, the prima- ry deficit could widen further to 1.9 percent of GDP in 2020 due to newly implemented tax cuts and exemp- tions, clearance of domestic arrears and backloaded capital spending from 2019.”

“Given risks to debt sustainability and large refinanc- ing needs over the medium term, renewed efforts to advance fiscal consolidation will be essential for macroeconomic stability,” Goretti added.

And she maintained that “measures to improve effi- ciency in the public administration and strengthen rev- enue mobilisation can help reduce the high public debt, while preserving space for critical social and investment needs. Advancing relevant legislation to strengthen fiscal rules would anchor policy commit- ments, restore confidence and safeguard sustainability over the medium term.”

FISCAL AFFAIRS Government revenue declined by 20.3 percent year on year to Rs. 476.7 billion in the first four months of 2020, according to the Mid-Year Fiscal Position Report 2020 published by the Ministry of Finance and Mass Media.

This is primarily attributed to a decline in tax revenue of 25.9 percent year on year to 408.5 billion rupees, on the back of lower revenue collection from income taxes, VAT, Nation Building Tax (NBT), excise duty on motor vehicles and liquor, CESS levy, Special Commodity Levy (SCL) and Telecommunication Levy.

However, non-tax revenue recorded an increase of 46.5 percent to Rs. 68.2 billion, which reflects “the increase in receipts from Central Bank profit transfers and rent income,” according to the Finance Ministry report.

Total revenue from income tax declined to 81.4 billion rupees in the first four months of 2020: corporate and non-corporate income tax increased by 35.7 percent to Rs. 57.8 billion; Taxes on Economic Service Charge (ESC), PAYE tax and with holding tax of selected sources were removed with effect from 1 January 2020.

Government expenditure amounted to 931 billion rupees during the first four months of 2020, reflecting a decrease of three percent compared to the equivalent period of the preceding year. This included recurrent expendi- ture of Rs. 821 billion and capex of 110 billion rupees.

“Reflecting the increased expendi- ture on the control of COVID-19, and affiliated healthcare expenditure, wel- fare payments to needy people coupled with increased interest payments, recurrent expenditure increased by 9.4 percent during the first four months of 2020,” the Mid-Year Fiscal Position Report 2020 notes.

It adds: “Total capital expenditure and net lending was streamlined against the backdrop of large unpaid bills stemming from 2019… With the Vote on Account in place [and] the COVID-19 breakdown in mid-March 2020, no new capital projects were implemented.”

In the January edition of LMD, economist Shiran Fernando outlined the potential challenges facing the economy over the course of 2021: “The domestic economy is delicately placed in terms of macro stability although it has weathered the COVID- 19 shocks extremely well.”

As he explained, “the focus of the government’s maiden budget for 2021 is to drive Sri Lanka’s economic growth back to five percent or more. In addition, the budget was widely wel- comed for providing tax policy conti- nuity, and focussing on major areas such as exports, investment, SMEs and infrastructure.”

“These focal points of the economy will need to rebound if Sri Lanka is to bounce back stronger in the new year,” Fernando asserted.

He is of the view that the budget did not completely douse the concerns of investors and global credit rat- ing agencies over Sri Lanka’s debt refinancing capabil- ity in the medium term: “Sri Lanka has an average of between four and 4.5 billion dollars in external debt maturing between 2021 and 2025. Budget 2021 did not include any substantially new tax revenue raising pro- posals despite anticipating a 27 percent rise in income driven by policy consistency and improved tax administration.”

Other areas of the economy such as exports, foreign direct investment (FDI) and remittances will also need to perform favourably, to ensure that Sri Lanka’s reserves are strengthened and can manage debt repay- ing commitments, Fernando believes.

And he stated that “tourism will have the potential to support the economy – particularly over the second half of the year – if efforts to roll out COVID-19 vac- cines in key tourist markets are successful.”

Fernando continued: “As such, the economy would need to manoeuvre itself carefully during the year, allay fears with regard to debt through strong commu- nication and action, and maintain a foundation for higher growth beyond 2021.”

COMPETITIVENESS Sri Lanka is placed 84th in the Global Competitiveness Index 4.0 2019 ranking compiled by the World Economic Forum (WEF), which notes that the country is the most improved in the region.

The accompanying report reveals that from a South Asian perspective, Sri Lanka exceeds the regional average for several indicators including its institutions, infrastructure, ICT adoption, health, skills and the labour market.

Meanwhile, Sri Lanka has moved up in the Doing Business 2020 index, advancing one place from the prior year to No. 99 of the 190 economies ranked. The latest rankings published by the World Bank Group reveal that Sri Lanka has achieved a Doing Business score of 61.8, which is the same as in the previous year.

In the report’s analyses, the island also stands as the leader in the South Asian region when it comes to reg- istering property, which is one of 10 topics considered in ranking an economy’s doing business environment. Meanwhile, the LMD-Nielsen Business Confidence Index (BCI) reflected a marked improvement in biz sentiment in January following negative momentum during much of 2020 as a result of the fallout from COVID-19 particularly amid the onset of a second wave of the pandemic in the island. A month later in February, the index stabilised and is now 10 basis points higher than its 12 month average.

POLICY REVIEW The State of the Economy 2020 publica- tion released by the Institute of Policy Studies (IPS) in October focusses on ‘Pandemics and Disruptions: Reviving Sri Lanka’s Economy COVID-19 and Beyond’ whereby it examines the policy contours of a country that builds back better from COVID-19.

According to IPS’ annual flagship report on Sri Lanka, the nation’s creditable health response to COVID-19 offers it an early advantage to tackle the economic fallout of the pandemic. The IPS notes that “all indicators suggest an economic contrac- tion in 2020, albeit with a very real possibility of a sharp V- shaped recovery thereafter. Such a recovery presents both an opportunity and a challenge for Sri Lanka. The emergency stim- ulus measures will combat the immediate deflationary shock but they can eventually stoke inflationary pressures and undermine a resilient recovery path.”

“Once the immediate COVID-19 crisis recedes, Sri Lanka has a very real opportunity to refashion its economic policy choices to determine the outcomes beyond COVID-19 and help greatly to mitigate risks of disruptive impacts from similar crises in the future,” it adds.

However, the economic policy research institute cautions: “The disruptive effects on incomes and livelihoods particularly in the context of large numbers in informal employment with inade- quate social protection cover elevate the risks of widening exist- ing income disparities in Sri Lanka.”

As the IPS points out, policy makers presently face a quandary in relation to the COVID-19 response on whether to continue with the current constraints (to reduce mortality and morbidity costs) or to relax the containment measures (to reduce the socioe- conomic costs).

“The tradeoffs between the two types of costs can be managed with proper government policies for managing the disease as well as for managing the adverse effects to the economy due to the disease. In the long run, the challenge for the government will be to strengthen institutions and expertise in the country so that the socioeconomic costs of disasters such as the pandemic are minimised,” it affirms.

In its analysis, the IPS contends that “Sri Lanka is highly vulnerable to different types of disasters. Frequent disasters have undermined economic growth and human development in the country. Preparedness can reduce the socioeconomic costs of a disaster. It is also important to build the capacity of existing insti- tutions for implementing relief and recovery activities in the long term. This has three reasons in common.”

It elaborates: “Firstly, such an institution can take a lead role in improving the disaster preparedness of the country, not only on the disaster response measures. Secondly, the experience of respond- ing to the current pandemic will help officials in a permanent insti- tute be better prepared to respond to future pandemics. Thirdly, strong and stabilised institutions can bring in necessary leadership in a future disaster even in a weak political environment.”

The IPS also asserts that “countries with well-established social protection systems are able to provide relief to the affected pop- ulation much easily. When existing social protection systems are not efficient, countries take measures to widen the existing sys- tems and increase benefits, to expand the coverage and adequa- cy of social protection.”

“However, such means of extending social protection is less efficient and can lead to errors in targeting, resulting in reward- ing the wrong families at the expense of vulnerable families. Such mistakes will delay economic recovery and hold back development. A well targeted social protection system will alle- viate such problems,” it remarks.

Moreover, technology, innovation and intellectual property rights would help revive Sri Lanka’s economy in the COVID era and beyond, the IPS believes.

And to this end, it recommends attracting private investment in R&D to at least meet the benchmark level of the developing countries; expanding commercialisation, technology transfer and business linkages; and adapting strategies to encourage innova- tions and patenting.