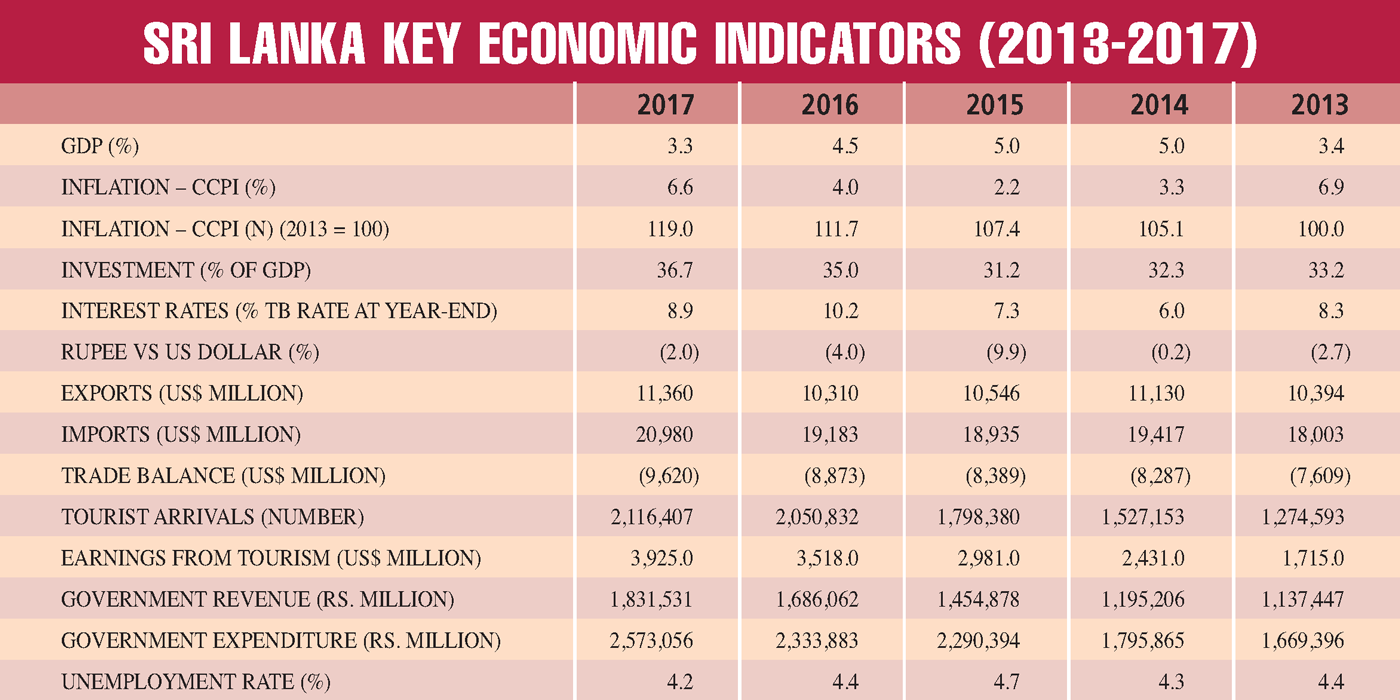

The Sri Lankan economy grew at a moderate pace of 3.3 percent year on year in 2017 compared to 4.5 percent in 2016 amidst challenges arising on both the domestic and external fronts, according to the Central Bank of Sri Lanka (CBSL).

CBSL notes that “severe drought conditions that prevailed particularly in the major cultivation areas hindered the growth in agriculture activities even though a rebound was observed during the last quarter of the year, benefitting from the recovery in paddy production during the 2017/18 Maha season.”

The monetary authority also states that activity in the industry and services sectors “contributed positively to economic growth” even against the backdrop of “spillover effects from subdued agriculture performance.”

SERVICES In 2017, services related economic activities (nearly 57% of GDP) expanded by 3.2 percent year on year in value added terms compared to the 4.7 percent increase in the previous year.

According to the Central Bank, the uptick in the services sector during the year was largely backed by the expansion of financial services together with developments in the wholesale and retail trades.

CBSL also cites growth in many segments including personal, accommodation and professional services; real estate; healthcare; transportation; insurance; telecommunications; education; and IT related activities for the expansion in the services sector. However, it notes that public administration services contracted in 2017.

INDUSTRY The value added of the industry sector recorded an upside of 3.9 percent in 2017 versus a 5.8 percent hike in the preceding year – this was mainly driven by the expansion in manufacturing activities.

Construction, and mining and quarrying, witnessed a slowdown during 2017. In addition, other industry sector related activities such as electricity; sewerage; waste treatment and disposal; and water collection, treatment and supply registered positive growth compared to the previous year.

AGRICULTURE Reflecting the impact of adverse weather conditions, agriculture, forestry and fishing activities contracted by 0.8 percent in value added terms in 2017 in comparison to the 3.8 percent decline of a year back.

The Central Bank notes that the performance of the sector “was negatively affected by the unfavourable weather conditions that prevailed particularly during the first nine months of the year” but “witnessed a recovery during the last quarter.”

VIEWPOINTS In its latest update to the Asian Development Outlook (ADO) report, the Asian Development Bank (ADB) in its commentary on Sri Lanka states that “with external demand coming off a high base in [the] second half of 2017, and little change expected in investment and government expenditure, projections for growth in 2018 and 2019 are marked down from ADO 2018. A downside risk stems from approaching elections.”

The ADB acknowledges that “the government is implementing wide-ranging structural reform supported by the International Monetary Fund. Fiscal performance improved with tax revenue rising as a share of GDP and a small primary surplus in 2017” while stressing: “Heavy debt repayments coming due in the next few years underscore the need for continued structural reform.”

In the first quarter of 2018, GDP growth remained subdued at 3.5 percent year on year. Agriculture recovered with better weather to grow by 5.3 percent as rice production increased by 53 percent, partially reversing the contraction in the first quarter of 2017. Services advanced by 4.8 percent but industry expanded by only 1.1 percent, held back by a 4.7 percent decline in construction and only modest growth in manufacturing.

The ADB observes: “The first quarter [of 2018] saw private consumption revive, continued tightening in government consumption spending, stagnant fixed investment and lower net exports.”

“Normalising agriculture in 2018 and a high base last year brought headline inflation down to 1.6 percent year on year in April. It picked up to 3.4 percent in July on higher food prices, currency depreciation, rising global oil prices and the government’s adoption in May of automatic fuel pricing. These pressures and the scheduled introduction of automatic pricing for electricity later this year will see inflation trend higher, to average 4.5 percent in 2018, which is below the ADO 2018 forecast,” the Asian lending institution asserts. “With lower than anticipated growth in 2019,” it says the inflation forecast has also been tweaked. “Weakening inflation and growth led the Central Bank of Sri Lanka to ease monetary policy in April by lowering the standing lending facility rate by 25 basis points,” ADB adds.

Exports grew by 6.2 percent in the first half of 2018 with garments and textiles expanding by 5.7 percent. Imports rose by 12.7 percent mainly due to higher fuel prices, gold for jewellery and personal vehicles while a 0.6 percent decline in the import of investment goods “underscores the lacklustre investment environment,” it opines.

The trade deficit widened by 20.2 percent while its main offsets – earnings from tourism and remittances – increased by 5.8 percent.

The ADB informs: “With higher oil prices, high dependence on imports and only a marginal recovery in remittances, projections for the current account deficit are raised for both 2018 and 2019. The Sri Lankan Rupee has depreciated against the dollar all year, ending five percent lower at the end of August. Gross official foreign exchange reserves peaked at US$ 9.9 billion in April 2018 with sizable capital inflows but fell to US$ 8.4 billion in July.”

Meanwhile, the IMF forecasts that the Sri Lankan economy will grow by 3.7 percent in 2018, and 4.3 percent and five percent in 2019 and 2020 respectively, according to the October 2018 edition of its World Economic Outlook (WEO) report.

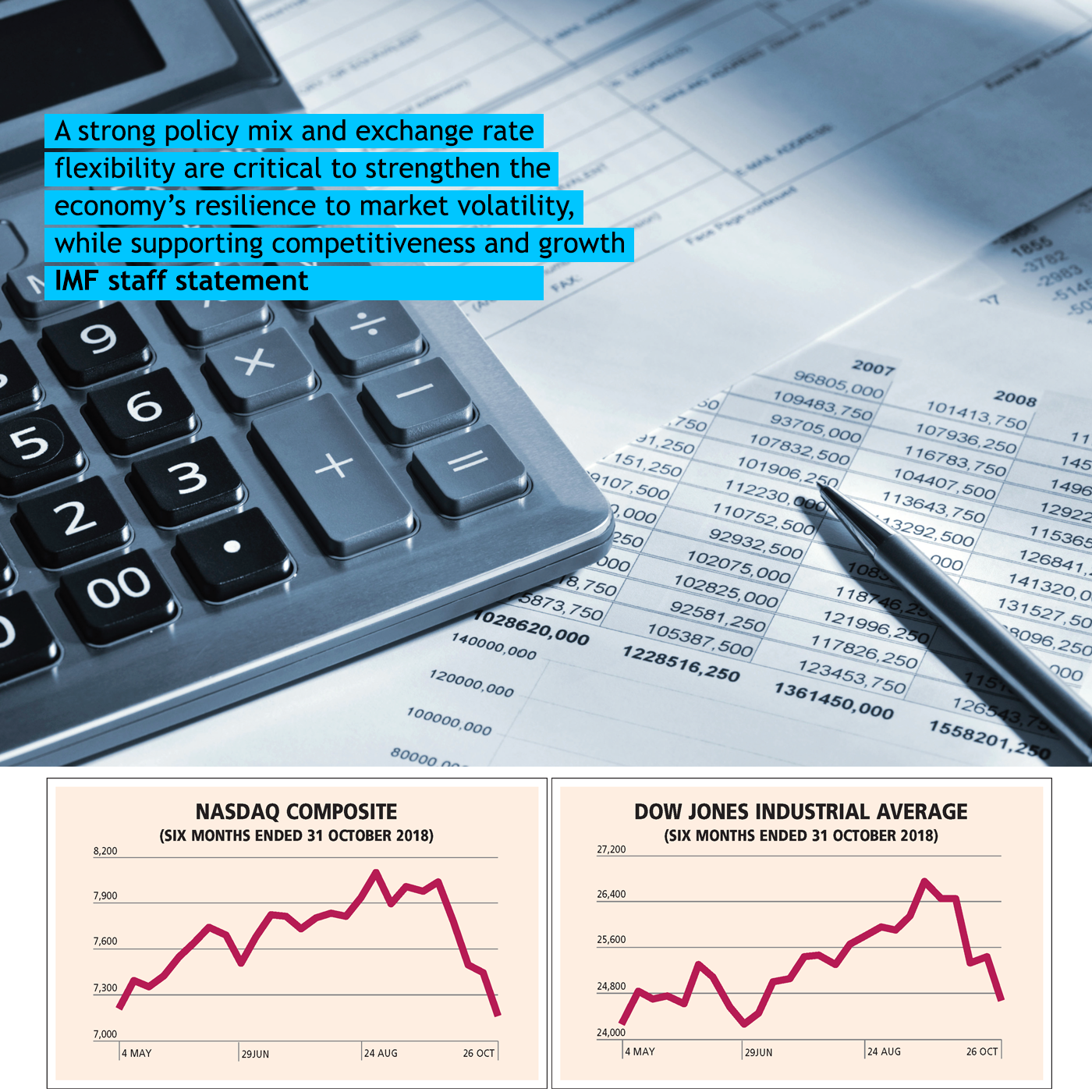

In September, an IMF staff team concluded a visit to Sri Lanka to discuss progress of its economic reform programme, and conveyed that “a strong policy mix and exchange rate flexibility are critical to strengthen the economy’s resilience to market volatility, while supporting competitiveness and growth.”

It also noted that “advancing revenue based fiscal consolidation in the 2019 budget can support Sri Lanka’s ambitious social and development goals while reducing public debt,” whereas “the authorities should sustain reform efforts to support trade, investment and inclusive growth.”

FISCAL AFFAIRS Government revenue grew by 5.6 percent year on year to Rs. 622 billion in the first four months of 2018, according to the Mid-Year Fiscal Position Report 2018 published by the Ministry of Finance and Mass Media. This increase in government revenue is attributed to higher revenue collections from income tax and excise tax.

Tax revenue increased by 2.8 percent to Rs. 570 billion between January and April compared to 555 billion rupees in the corresponding period of 2017, “reflecting the increase in revenue generated from income tax and domestic consumption, and import based taxes,” the Finance Ministry report notes.

Meanwhile, non-tax revenue in the four months ended 30 April increased by almost 50 percent to Rs. 52 billion due to profit transfers from the Central Bank, and increased income and social security contributions, although revenue generated from rent, profits and dividends contracted.

The Mid-Year Fiscal Position Report 2018 reveals that government expenditure was Rs. 873 billion during the first four months of 2018, representing a 6.1 percent increment versus the corresponding period in the prior year.

Recurring expenditure grew by 9.5 percent year on year to 187 million rupees due to increased salaries and wages of government employees and pensioners, and interest payments, while public investment declined by 9.5 percent in the review period.

Gross borrowings of the government surpassed Rs. 670 billion during the first four months of 2018, of which domestic borrowings accounted for nearly 535 billion rupees and foreign borrowings amounted to Rs. 136 billion.

According to the ministry report, “in addition to the financing of domestic debt service payments, domestic borrowing [was] also utilised to finance a part of foreign currency debt service payments during the period. The net borrowing at [the] end of the period was Rs. 306.3 billion.”

At the 2018 Annual Meetings of the IMF and World Bank Group, then Minister of Finance and Mass Media Mangala Samaraweera stated: “[The] Sri Lankan economy is expected to record a modest growth of around four percent in 2018 as the economy still grows below potential. However, the growth is expected to recover and gradually move to a higher path, benefitting from the ongoing structural reforms, improved productivity and enhanced investments with improved investor confidence.”

He revealed that “a significant improvement has been achieved on the fiscal front, reflecting strong commitment of the government towards the ongoing revenue based fiscal consolidation process. We have now balanced the primary account of the budget, and expect a considerable primary surplus in 2018 and beyond.”

“The new landmark tax policy reforms and improvement in tax administration, and prudent expenditure management, coupled with the improvement in public debt and public financial management, as well as reforms in the state owned enterprises (SOEs), are expected to strengthen the country’s fiscal position further,” he added.

In the December edition of LMD, economist Shiran Fernando highlighted the fact that Sri Lanka’s export basket remains concentrated and the much talked about diversification hasn’t really transpired in terms of the numbers.

“While Sri Lanka only added seven new products to its export portfolio between 2000 and 2015, the per capita GDP value addition was a mere US$ 5. However, if you were to consider the likes of Vietnam, which added 48 products to its export portfolio during this time, the value to per capita GDP was almost 100 times at 545 dollars,” he laments.

Fernando adds: “R&D as a share of GDP was only 0.1 percent in 2017… While funding is one of the missing pieces of the puzzle, there also has to be integration among existing research institutions and an improvement in the intellectual property regime … This has reduced the country’s opportunity to expand the manufacture of high value products and exports.”

COMPETITIVENESS Sri Lanka is placed 85th in the Global Competitiveness Index 4.0 2018 ranking compiled by the World Economic Forum (WEF), which discloses that from a regional perspective, the country boasts the highest healthy life expectancy (67.8 years), a workforce with the longest schooling (9.8 years) and the most modern utility infrastructure in South Asia.

The accompanying report observes: “In spite of growing international flows, South Asia remains the region with the lowest trade penetration in the world, with imports and exports of both services and merchandise goods amounting to approximately 39 percent of regional GDP in 2017.”

“South Asian economies apply an average tariff rate of 15 percent to imports from the rest of the world. Investment flows and integration into global value chains have also so far been rather limited … ICT adoption and innovation capability are the two areas where the region lags even further behind the rest of the world with the region’s median performance at only one-third of the global theoretical frontier,” it adds.

Meanwhile, Sri Lanka has moved up in the Doing Business 2019 index, advancing 11 notches from the prior year to No. 100 of the 190 economies ranked. The latest rankings published by the World Bank Group reveal that Sri Lanka’s Doing Business distance to frontier – i.e. how close the economy is to the global best performer – has improved marginally to 61.22 from 58.86 in the previous year.

In the report’s analyses, the island has improved its standing for starting a business, dealing with construction permits, obtaining electricity, registering property, paying taxes, enforcing contracts and resolving insolvency. However, it recorded no change in the areas of obtaining credit, protecting minority investors and trading across borders.

Nevertheless, as the LMD-Nielsen Business Confidence Index (BCI) affirms, biz sentiment has been in the doldrums for the better part of 2018.

POLICY REVIEW The State of the Economy 2018 publication, which was released by the Institute of Policy Studies (IPS) in October, focusses on ‘Climate Change, Food Security and Disaster Risk Management.’

In its analysis, the IPS report points out that “more so than ever, the outlook for the Sri Lankan economy at present is heavily intertwined with the country’s often unpredictable politics. This is because Sri Lanka began to experiment with a national unity government in 2015 that brought together traditional political foes into an uneasy alliance. Three and a half years later, the performance of the government on the economic front is mixed.”

It continues: “After a shaky start, macroeconomic stability is being regained under the IMF programme that is set to run until June 2019. While GDP growth is still at a modest 3.5 to four percent, the medium-term growth outlook is more promising; a more sustainable growth outcome can emerge from the sounder macroeconomic base, and complementary reforms that are underway to encourage exports and attract private investment.”

As aptly noted in the State of the Economy 2018 report, “Sri Lanka’s politics brings the biggest uncertainty to any economic forecasts. From 2018, an electoral cycle kicks in until all the way to presidential election in late 2019 or early 2020. The first test of electoral popularity for the ruling coalition [at the time] at local government elections in February 2018 did not go down well. In the weeks and months that followed, cracks in the coalition were laid bare that clearly has implications on the country’s economy.”

And to this end, it notes that the implications are twofold – viz. the impact on the speed of reforms, policy consistency and predictability; and the potential downside risk of loose macroeconomic management to allow more populist measures to creep in on the fiscal policy front, and/or easing of monetary policy measures to provide financial relief to both businesses and households.

“The former has manifested in the scrapping of the Cabinet Committee on Economic Management (CCEM) to bring economic policy discussions under a National Economic Council (NEC). Backtracking on announced policies, which are often reintroduced subsequent to clarifications – such as on fuel pricing – are examples,” the report maintains.

In relation to Sri Lanka’s large medium-term foreign debt settlements due from 2019, IPS emphasises: “For refinancing risks to be contained, continuing with the IMF programme that imposes fiscal and monetary policy discipline will be quite critical. However, nothing can be ruled out. If politicians adopt a short-term view with only an eye toward winning the next election, the gains of the recent past can be reversed.”

“The more likely outcome is a slowdown in reform initiatives and modest adjustments to alleviate voter dissatisfactions that will yield more of an unexceptional ‘business as usual’ economic performance in 2018. Indeed, the CBSL’s second downgrade for Sri Lanka’s 2018 GDP forecast by 0.5 percentage points in May 2018 to an expected GDP growth rate of four percent for the year lends credence to the supposition,” it asserts.

IPS cautions that the economy is highly exposed to shocks – be it domestic in the form of weather related disasters; or external in the form of international interest rate adjustments.

In this regard, it remarks that “Sri Lanka’s excessive reliance on foreign capital to finance investment under favourable external financial conditions is now leading to disruptions as those conditions change. The options for the country are to either allow a currency depreciation or delay it by drawing down foreign reserves. The latter is not a tenable strategy for any extended period of time given Sri Lanka’s limited buffer stock of reserves.”

According to the policy think tank, “as the depreciation of the rupee raises the country’s debt liabilities, Sri Lanka must look to strong and resilient increases in GDP to constrain debt ratios and lower refinancing risks on its medium-term foreign debt settlements.”

“The demands on policy makers are many in this challenging environment. The risks are also high; the state of the economy will exert an ever more powerful influence on the electoral battles ahead,” it concludes.

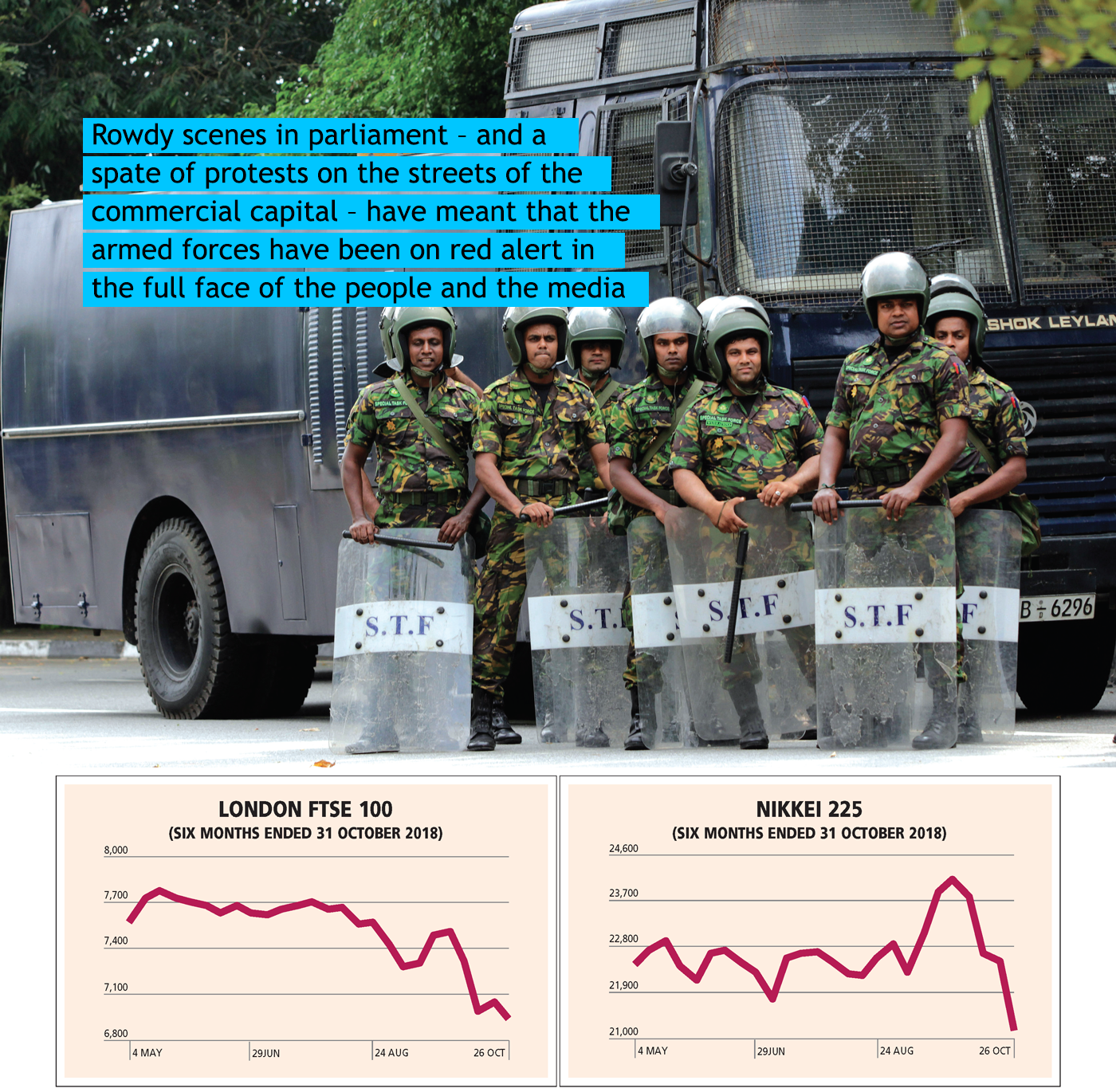

As for the present, Sri Lanka’s state machinery has been on virtual shutdown since the turn of events following 26 October when the president moved to appoint a new prime minister, which was followed by a round of musical chairs within cabinet ranks and some heads of state institutions. Thereafter, rowdy scenes in parliament – and a spate of protests on the streets of the commercial capital – have meant that the armed forces have been on red alert in the full face of the people and the media.

None of this augurs well for the nation’s image in the eyes of the world, which means that there’s now a real risk of investor apathy, downgraded country ratings (we have already witnessed this courtesy Moody’s) and the prospect of mayhem in anticipation of elections.

The country now finds itself on a knife-edge with its fate seemingly in the hands of the Supreme Court, which is due to rule on what’s right or wrong – and this in turn will hopefully end the political stalemate and pave the way for a general election (and perhaps a presidential poll too) so that the people of the land can vote for one or the other… or indeed, some other!